Big National Brands As Amazon Sellers

There is a struggle being waged between big national / multinational brands and Amazon. Many big brands are interested in selling their own products on Amazon’s Third Party Marketplace (3P). Amazon does not want this to happen. Amazon prefers to keep these brands as vendors and to purchase products at traditional wholesale prices directly from them. This is called a First Party relationship (1P).

Amazon’s Motivation for Keeping Big National Brands As Vendors:

As cited in Amazon’s US Congress Antitrust Response: If you 1) are a national brand 2) supply your products to other major retailers and 3) have a long-standing vendor relationship with Amazon they are unlikely to let you become a Seller on the marketplace. They insist that this "ensures that Amazon can provide competitive prices, availability, and fast delivery for the most popular products in Amazon’s store, and avoids customer confusion and operational complexity." While the brand itself is restricted from selling its own products, Amazon will allow other sellers to sell that brand's product, undermining their claims that they must be the seller to "avoid customer confusion and operational complexity." In reality, it comes down to Amazon's desire to control the price of key value items (KVIs).

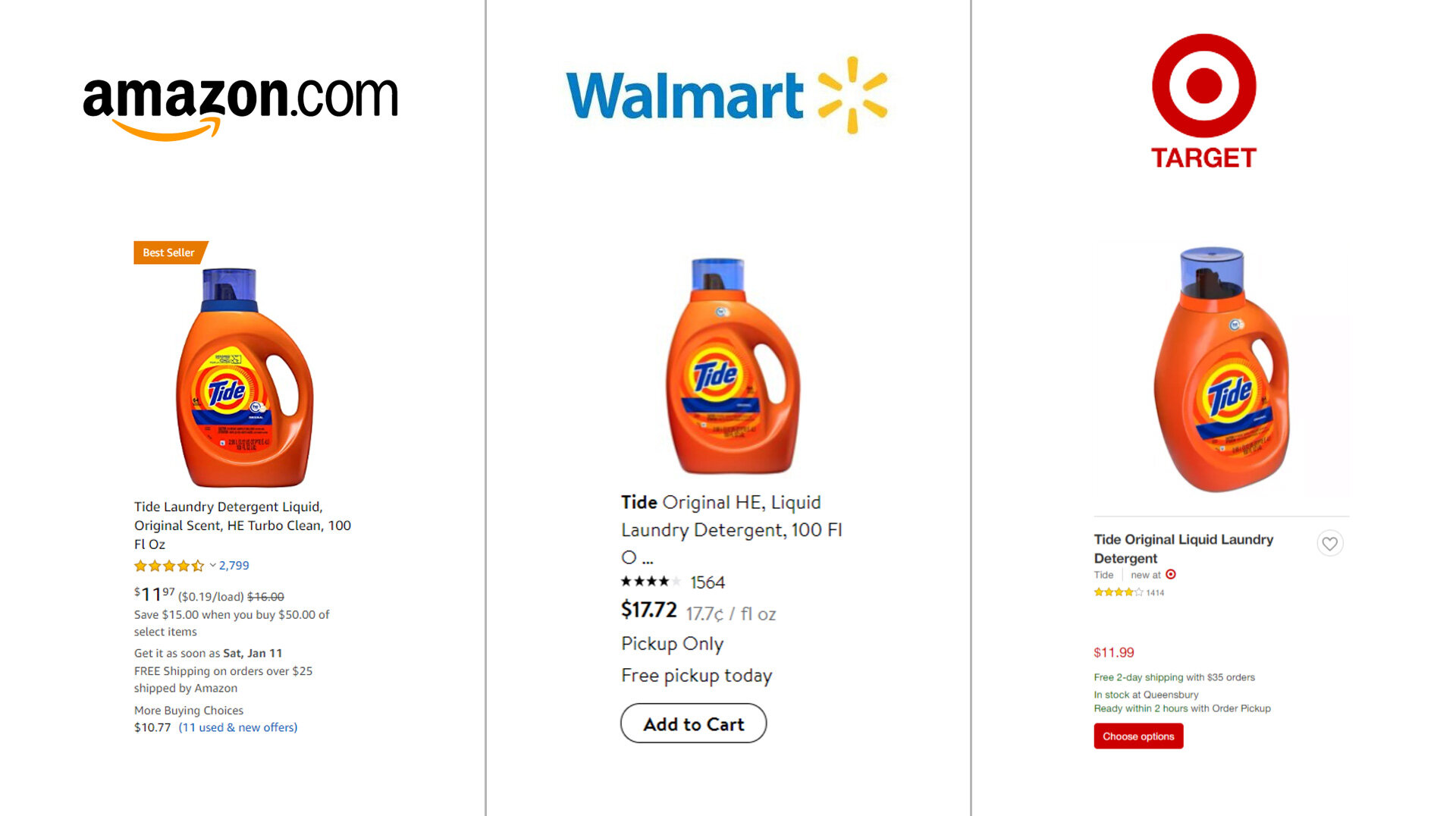

Demonstrating Amazon’s push to have the lowest price on items vs. retailers such as Walmart and Target

Big national brands attract buyers and the products they sell are typically trusted by consumers. They act as a honeypot to attract and convert customers. Offering the lowest price on these memorable items creates the perception that your “store” offers the best consumer value and creates customer loyalty. That psychology shapes traffic patterns over longer time frames. This is called a value-perception driver.

By purchasing the products of big national brands at wholesale prices, Amazon can suppress the retail price of this item and offer the customer the best price. It reinforces that low price by allowing other third party merchants to compete in a downward price auction in the Buy Box (where the seller that offers the best price and shipping package for the item is the default seller).

The Amazon Buy Box for Tide

The Lure of Enterprise Advertising Spend

There is another reason Amazon wants to force big national / multi-national brands to be Vendors… it wants control over their advertising dollars. Advertising is profitable and Amazon still has a relatively small share of the digital advertising market… 3% in 2018 according to Juniper Research. This market is expected to reach $520 billion by 2023. Amazon wants more of Google’s and Facebook’s digital advertising marketshare as well as the advertising dollars traditionally spent on television. Brands that are Vendors have signed contracts with Amazon that set aside budgets for advertising spend. Amazon can also pressure brands to provide more advertising dollars or drop their wholesale price so that Amazon can allocate more money to advertising by itself. If brands operated as Sellers, Amazon would have no say in how much these brands spent on advertising.

While this is good for Amazon, it is not good for the business of big brands.

The Advantages of Being a Seller

To better understand the advantages of being a seller, let’s begin with something Jeff Bezos acknowledged in the annual letter to shareholders for 2019:

“Something strange and remarkable has happened over the last 20 years:

1999 3%

2000 3%

2001 6%

2002 17%

2003 22%

2004 25%

2005 28%

2006 28%

2007 29%

2008 30%

2009 31%

2010 34%

2011 38%

2012 42%

2013 46%

2014 49%

2015 51%

2016 54%

2017 56%

2018 58%The percentages represent the share of physical gross merchandise sales sold on Amazon by independent third-party sellers – mostly small- and medium-sized businesses – as opposed to Amazon retail’s own first party sales. Third-party sales have grown from 3% of the total to 58%. To put it bluntly: Third-party sellers are kicking our first-party butt.”

While Jeff may find this both “strange and remarkable,” it isn’t. Amazon doesn’t care which brand or product a customer buys, as long it is bought from them. Amazon has little incentive to promote or protect your brand over others. It also won’t provide the TLC needed to sell the product properly or do accurate forecasting for seasonal products. Brands do care which product the customer buys, what condition it is in, how their brand and product is represented and that the inventory matches the sales cycle for the product. Brands also care about controlling their price, advertising and margins. They understand their product and their market far better than Amazon ever will and are more invested in the outcome of every marketing effort and set-back. In the case of an interested party versus a disinterested party, the interested party will typically win.

Wow Skin Science (an Amazon Seller) has the best selling product in Amazon’s Shampoo & Conditioners Sets category

If you are a brand and want to control that brand, you want to be a Seller not a Vendor. By being a Seller you can control your inventory, product listing, price, advertising, customer service and so much more. Small brands (generally thought to be under $10 million in sales) are mostly permitted and/or encouraged/forced to switch to Seller Central. If you were keeping up with the Amazon news in March 2019, there was a big controversy around this. Bigger national brands defined as those that supply their products to other major retailers and/or having a long-standing vendor relationship with Amazon will generally be restricted from making the switch. Amazon told the US Congress that this number is limited but without supporting data, cursory evidence would suggest that that would be a fairly liberal interpretation of the word “limited.” Don’t believe us? Try to find a big national brand that isn’t listed later in this article, who is selling their own product (there may be some but they are few and far between). Is Amazon being anti-competitive? Yes, it appears so. As a national brand, you are being forced by Amazon to adhere to a different system and relinquish control over your product and marketing to participate. You might be operating under a different system, with different rules and margins than your competitors. This is why, generally speaking, small unknown brands (many of them Chinese) are dominating Amazon. The system favors the small guy.

Smaller, lesser-known brands are dominating many categories on Amazon

The Dual Dependency Between Amazon and the Most Valuable Brands

By forcing big national brands to wholesale their products and relinquish control over price, branding, inventory planning and margins, while simultaneously not fully protecting that brand from listing hijacking, counterfeit goods and intellectual property violations, Amazon fosters fraught relationships with the nation’s most valuable brands. Some play ball with Amazon, some avoid Amazon and others have on-again/off-again relationships with Amazon (think Nike).

In reality, these brands are the brands that Amazon most covets. They have the most lobbying power with Amazon to enact change. Brand Registry, Transparency and Project Zero are all intellectual property and anti-counterfeiting measures that have been developed by Amazon under pressure from these brands. Amazon is more prone to modify its business than lose too many of these brands which it needs to attract and retain customers.

To the chagrin of many executive teams, these brands also need Amazon. Malls are dying. Big box stores are going bankrupt and shuttering locations. And in the online shopping world, 49% of US internet users typically start a product-oriented search on Amazon—these shoppers don’t even bother with Google or Bing. At one point, a company we worked with had 444 orders on Amazon for every one order on their website (those numbers are probably more skewed today). The long and short of the matter is; for many brands their customers are shopping only on Amazon. Market growth is there. If they aren’t represented there, their customers will most likely opt for another product from another brand. They will get that product in two days or less without paying for additional shipping, which few other online options can offer. With few exceptions, executives who believe that they can go-it-alone and still find future prosperity have mistaken their desire for another option, with that of a viable plan.

How can this be solved? A happy medium for solving this friction would be for Amazon to relent and allow Brands to run their own businesses on its marketplace. A small fraction already are.

The Brands That Are Selling Their Own Products

Who are the outliers? Who are the big national brands that are permitted to sell their own products on Amazon? Who can other national (or global) brands turn to for advice on how to become Sellers? We combed through over 2500 of the highest ranked sellers on Amazon, asked around, and kept our eyes open—and these are the only brands we found (if you know of more let us know and we will update this blog post).

Jockey

GORILLA GRIP

The Disney Store

Party City Inc

Eddie Bauer

Lands’ End

WW (Weight Watchers)

WeatherTech

Jumping Beans

Hickory Farms

National Geographic Toys

Stomp Rocket

Omaha Steaks

and of course… Amazon

Please Note: There were a few other major national brands (mostly retailers) who were also present, but they were not primarily selling their own branded or private-labeled products, so we didn’t list them.

If you are like us, you probably want to hear the stories of these brands and how they were able to escape being Amazon Vendors. They would make great speakers at events or interviewees for news stories. Are they great negotiators? Did they restrict selection available on Amazon? Did they not have pre-existing Vendor relationships? Were their products not considered key value indicators? What set them apart? There are many more big national brands that would like to follow suit. Hopefully, they will share their stories.

Summary

The tug-of-war that is being waged between brands and Amazon over which way to operate is far from over. It will be interesting to see how this plays out in the coming years. Will more national and global brands be able to make the switch? Will they band together to persuade Amazon to allow them to control their own businesses? Will antitrust pressure from the government force Amazon to let the brand decide? No doubt, there will certainly be brands who abandon the platform… and some who return with better arrangements. Either way, if you need help with your brand or products on Amazon, we can help. Please contact us for a FREE Consultation.